In the United States, the first Friday of June is designated as "National Anti-Gun Violence Day" to commemorate the victims and survivors of gun violence. The United States is the country with the most serious gun violence in the world. According to the real-time data of the non-profit organization "Gun Violence Archives", as of May 31, local time, in 2023, 17,650 people in the United States had been killed by shootings, and the number of mass shootings reached 268, equivalent to an average of 1.8 per day. And this number is rising year by year.

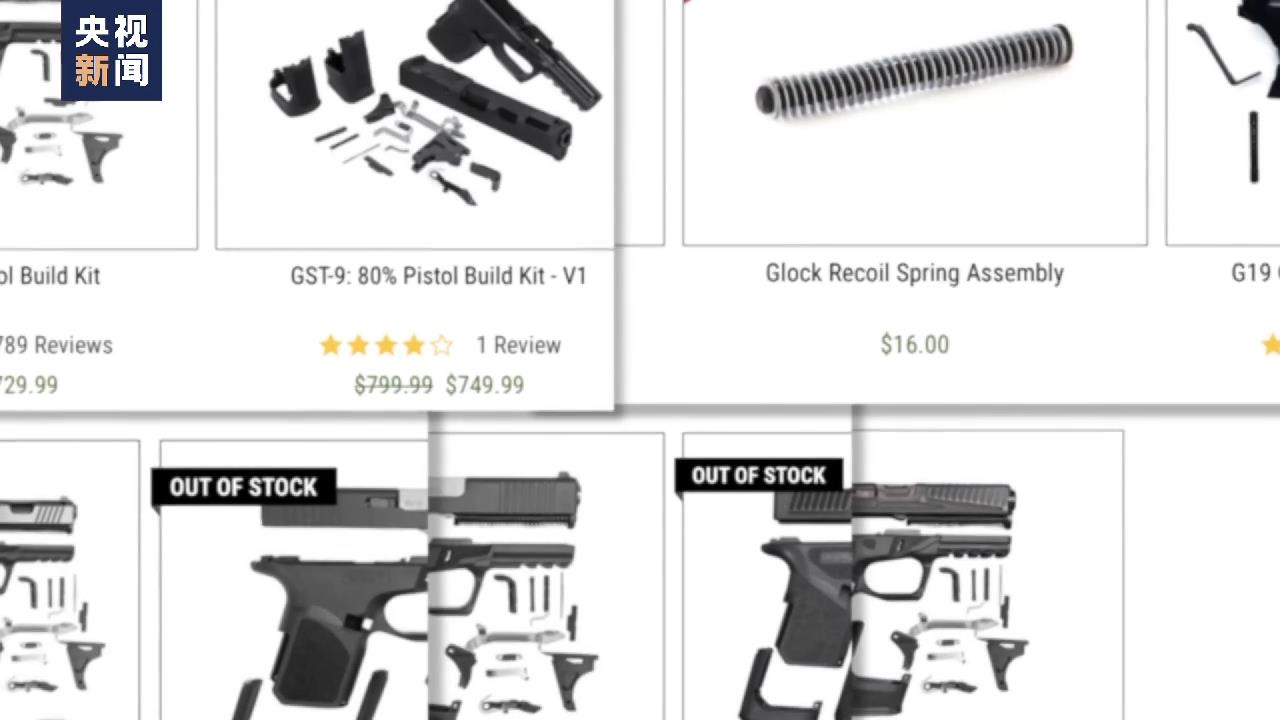

The Second Amendment of the American Constitution gives citizens the right to keep and carry weapons. The ease of buying guns in the United States has become a strange phenomenon. People can even buy guns in supermarkets and bullets in vending machines. However, in recent years, a new kind of gun is challenging the already very weak gun management regulations in the United States: "ghost gun", a weapon that can be assembled by itself without any license, can not be tracked, and even at home. What is a "ghost gun", who is making it, and who is using it? Let’s look at the investigation report brought by Liu Xiaoqian, a CCTV reporter in the United States: "Ghost Gun Chasing the Murder".

"Ghost Gun" party scans American 3D printing gun crowd

Amid the incessant gunfire in the United States, a new threat is quietly appearing.

The "ghost gun" is actually visible and tangible, so it is named because it has no serial number of the gun and cannot be tracked by law enforcement agencies. At the same time, this ghostly existence is flooding the network. People can mail-order gun parts at will, even people without foundation can assemble them themselves, and even a USB flash drive can print a gun in 3D.

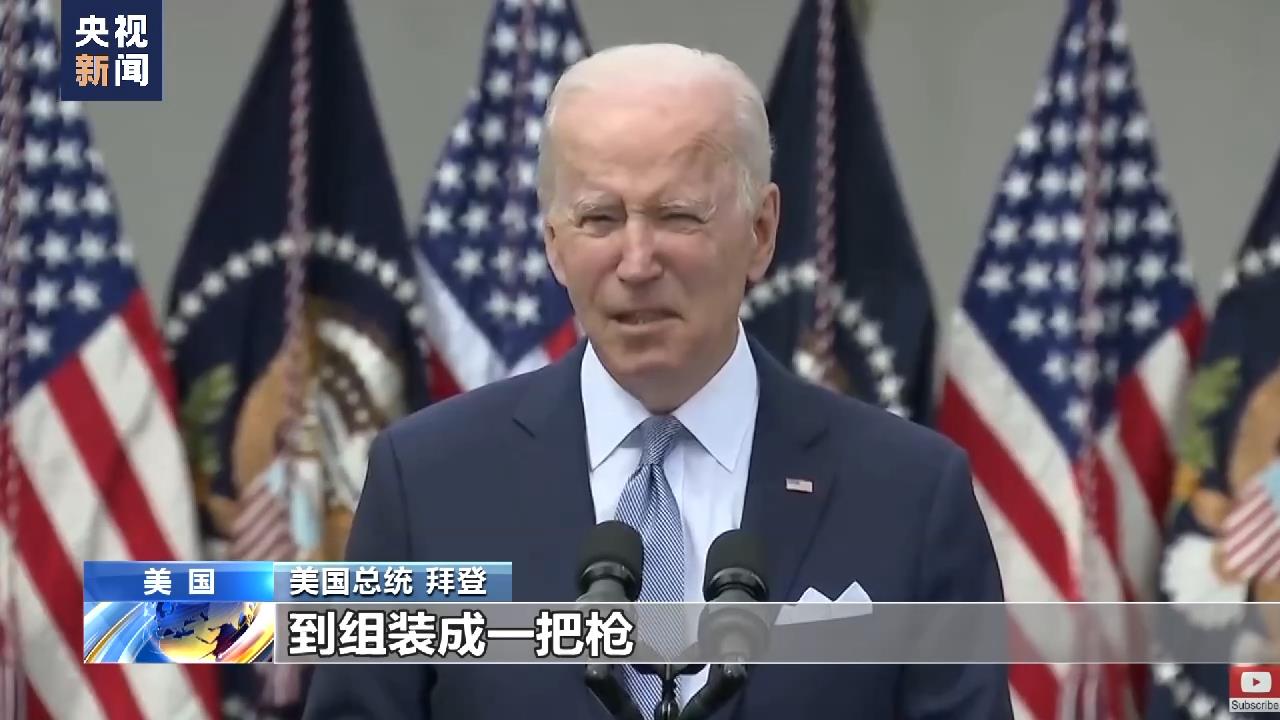

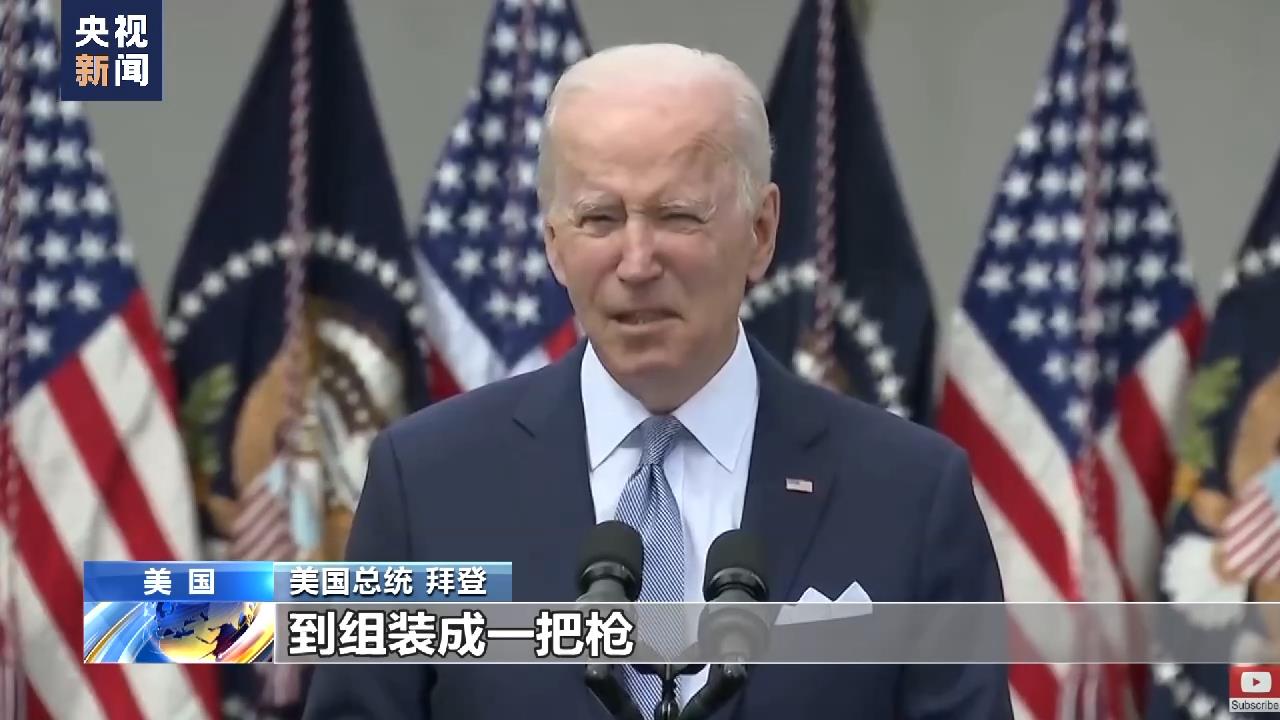

US President Biden:Whether it is a terrorist or a domestic abuser, it takes only 30 minutes from obtaining gun parts to assembling a gun.

According to the data of the US Department of Justice, in 2021, the number of "ghost guns" seized by the US police at the crime scene reached 20,000, 12 times that of 2017.

Why can the "ghost gun" escape the supervision of American law? And can the lethality of a 3D printing gun be comparable to that of ordinary guns?

We went to Florida to find out.

What will be held here is the only 3D printing gun competition in the United States. We started to contact the organizers through different channels six months ago, but we finally got permission to shoot on the eve of the competition.

CCTV reporter Liu Wei:Before the official start of the competition, the organizers are making some safety instructions and introductions. Some of them are only about one year old, and they all started with 3D printing guns.

The competition is divided into three categories: pistol, rifle and carbine. Among the contestants, there are amateurs and representatives of companies specializing in the production and sale of 3D printed guns.

Reporter:The yellow part is printed in 3D?

3D printing gun enthusiast Dell:Yes, you can see its lines if you get closer.

Reporter:What material is it printed with?

3D printing gun enthusiast Dell:It is made of polylactic acid, which is printed layer by layer, and the printing time takes 2 to 4 days.

Reporter:What about the rest of the gun parts?

3D printing gun enthusiast Dell:You can buy the remaining gun parts online or in gun shops.

Reporter:Is this your first 3D printing gun?

3D printing gun enthusiast Dell:This is my first 3D printing gun, and it is also my first rifle. I only bought a pistol before.

Reporter:So you have no experience in 3D printing guns before. Is it difficult to make this gun?

3D printing gun enthusiast Dell:I watched some videos on the internet that taught people to assemble guns, especially the part of getting off the gun box, which lasted more than an hour. After reading it, I thought it should be no problem and decided to make my own gun.

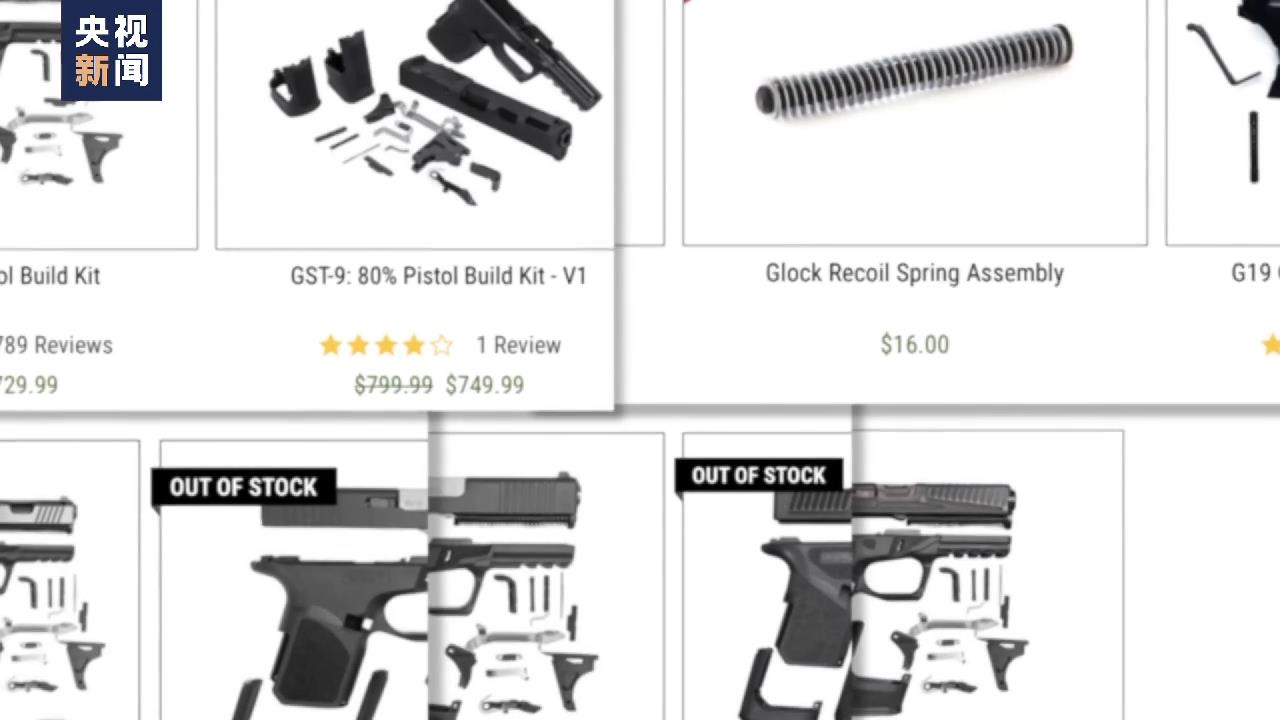

A gun consists of different parts, which can be metal or plastic. According to the current federal law of the United States, only the lower gun box is the decisive part of a gun. Once the gun box has holes for connecting and fixing other parts, it is recognized as a gun. On the contrary, it is just a piece of metal. The "ghost gun" is wandering in the gray area of this law.

3D printing gun manufacturer Jordan:This is an "80% gun magazine". It is only 80% completed. According to federal law, it is not a gun. This is the state when we sold it. You see, this is a completely processed lower gun box with holes in it. There is no problem if the customer drills the hole himself. If I drill the hole in the gun box and give it to you or sell it to you, it is equivalent to manufacturing guns. I need to apply for a license, and as a customer, you also need to do identity examination.

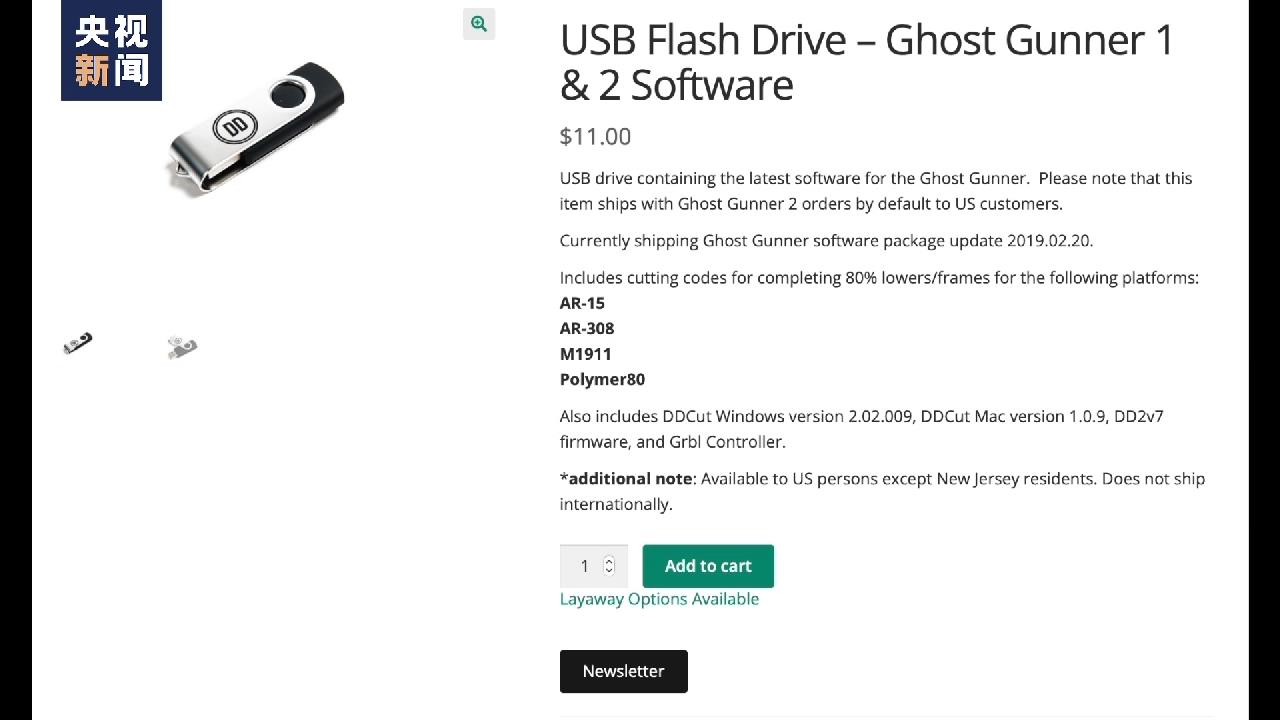

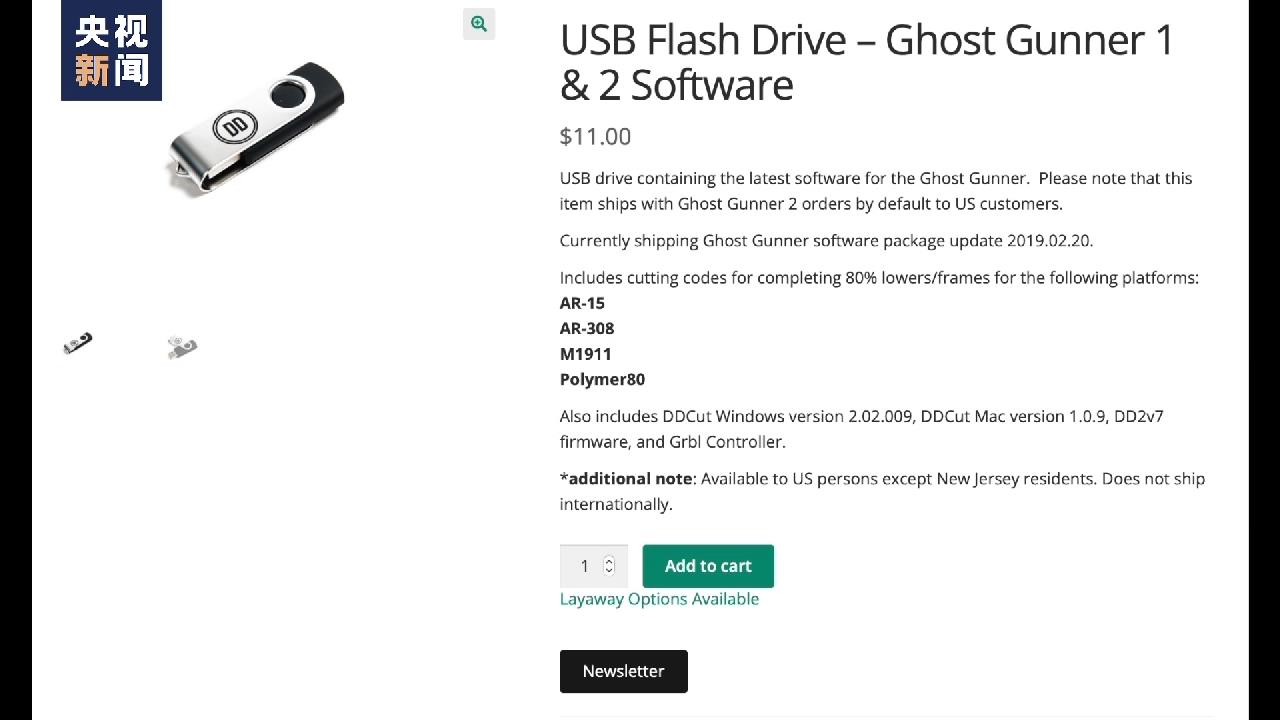

In fact, the magazine can also be obtained through 3D printing. One of the sponsors of the competition, the Texas-based "Distributed Defense" company provides a USB flash drive with a price of only $11, and customers can get the print data of various rifle magazines.

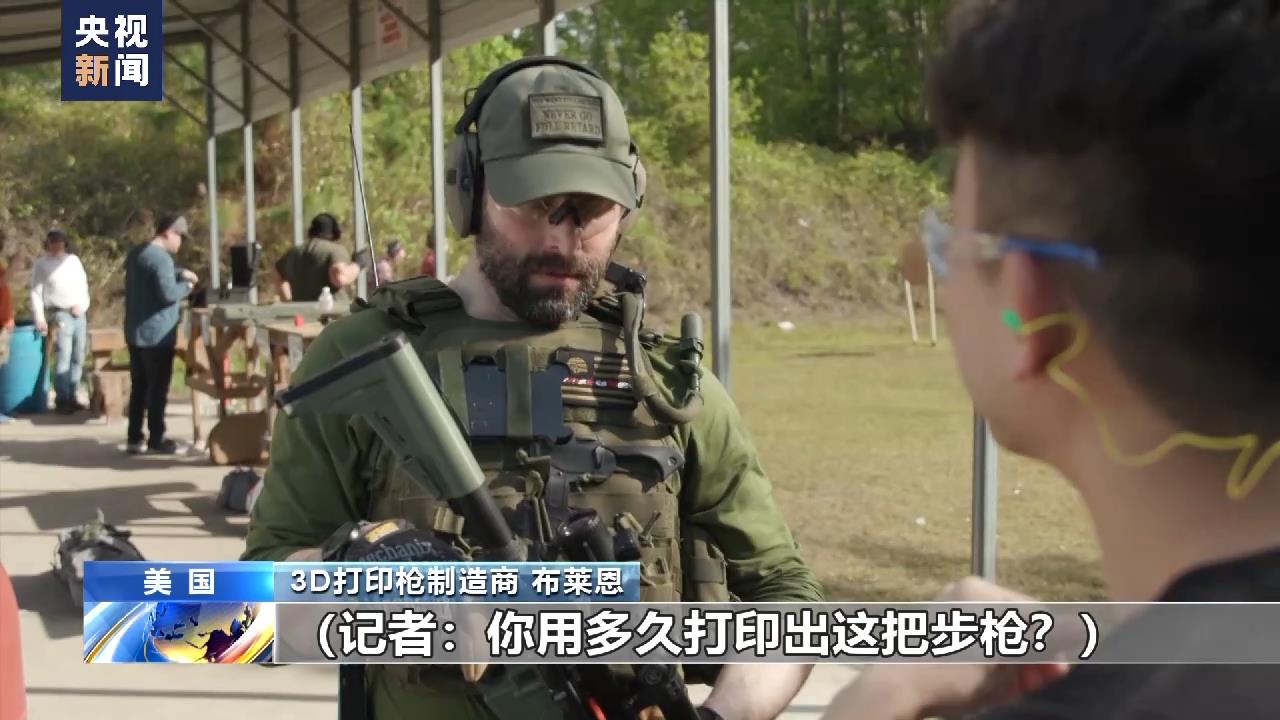

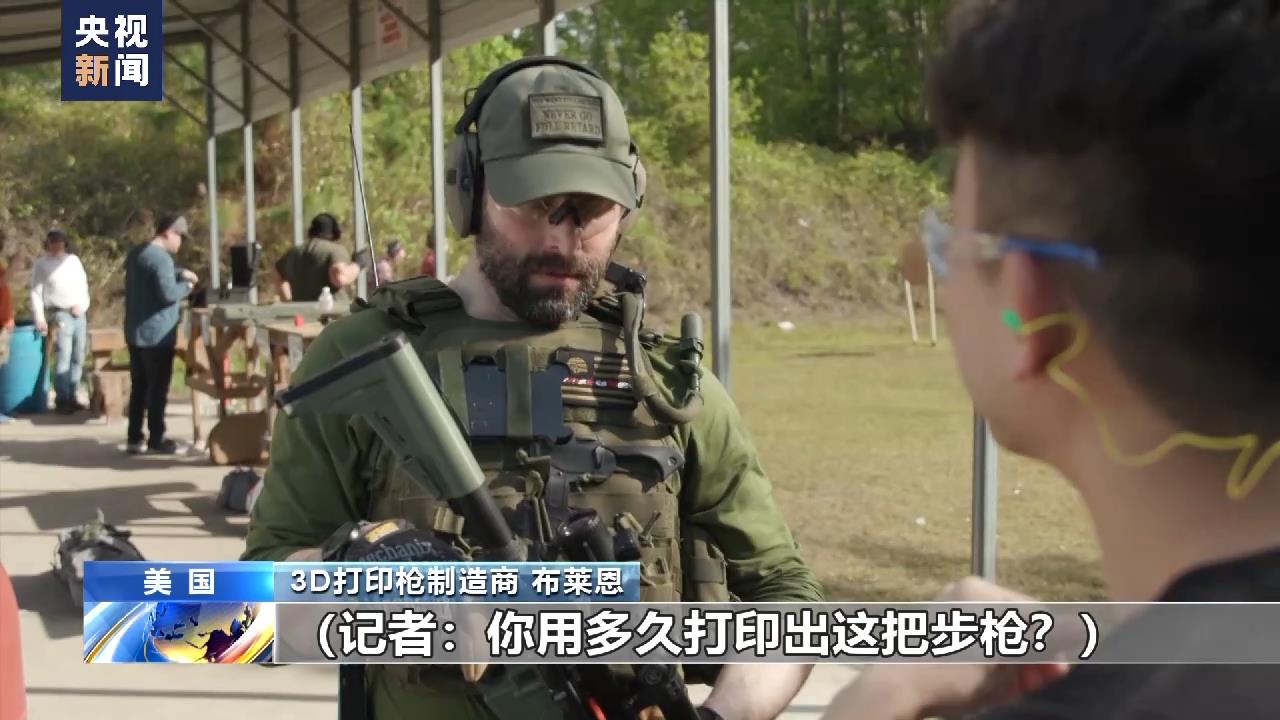

Reporter:How long does it take you to print out this rifle?

Brian, a manufacturer of 3D printing guns:The magazine was printed for 24 hours, the grip was printed for 15 hours and the cushion was printed for 6 to 8 hours.

CCTV reporter Liu Wei:Although the guns are printed in 3D, they all use traditional bullets. These are large caliber bullet casings that we found at the scene. In the process of watching, we also found that not all guns can be used normally, and some faults often occur.

3D printing gun enthusiast Ben:The previous bullet got stuck and failed to shoot, at the same time, the next bullet automatically entered the gun chamber.

At present, there are more than 80 companies that manufacture and sell "ghost guns" in the United States. Anyone can place an order without showing his identity documents, which means that the other end of the network may be a fan of 3D printing guns or a planner of mass shootings.

Reporter:As a seller of 3D printing guns, do you think we should do some basic customer identity checks?

3D printing gun manufacturer Jordan:I think there are many laws that restrict bad guys from getting guns. If a person prints guns just for his own use, I don’t think there is any problem.

Edgar Andyon, Organizer of 3D Printing Gun Competition:The "ghost gun" is just an object. Objects don’t do bad things. People use objects to do bad things.

Reporter:Do you think there is any way to prevent the "ghost gun" from falling into the wrong hands?

Edgar Andyon, Organizer of 3D Printing Gun Competition:I think this question is wrong. What you’re asking is actually how to prevent the bad guys from doing bad things. It’s very difficult, just like looking for a needle in a haystack. We can’t tell who the bad guys are from the crowd. This is a wrong direction.

The murderous 3D printing gun is the perfect crime weapon?

Anyone can place an order to buy, even people with zero foundation can teach themselves to make guns. While 3D printing gun technology brings fun to gun lovers, will it create more security risks for American society that is deeply poisoned by gun violence?

Many manufacturers of 3D printing guns insist that this self-assembled gun is the least likely weapon to be used by criminals.

Brian, a manufacturer of 3D printing guns:It takes you several days to print and assemble a gun. If a criminal needs to use a gun, they won’t waste time assembling it, but just buy a cheap and stolen gun.

However, a series of shootings have proved that the opposite is true. California is one of the most frequent areas of "ghost gun" violence. The local police said that more than half of the guns seized at the crime scene in recent years were "ghost guns".

CCTV reporter Liu Wei:Every year in mid-June, large-scale gun control demonstrations are held all over the United States. This is Grand Park in downtown Los Angeles, and one of the people calling for this activity is the victim of the "ghost gun".

Mia Tretta, Survivor of the "Ghost Gun" Campus Shooting;At that time, we were talking and laughing when we suddenly heard a gunshot. When the second gunshot sounded, I had fallen to the ground. I got up and ran into the classroom. My classmates and teachers rushed to stop the bleeding for me. I was shot by an unknown classmate and a minor with a .45 caliber "ghost gun".

Mia Tretta is from Santa Cralli Tower in Southern California. In November 2019, a large-scale shooting happened in her middle school. A classmate pulled out a "ghost gun" from his backpack and shot at the crowd, causing five injuries to two dead.

CCTV reporter Liu Wei:The shooter at Sagos High School was only 16 years old. The weapon he used was a 3D printed .45 caliber semi-automatic pistol. Because the gun has no serial number, the police can’t determine its source and the time when it was made.

The minimum age for holding a gun in California is 21. Because the murderer committed suicide after the attack, the police can’t determine who bought and assembled the "ghost gun".

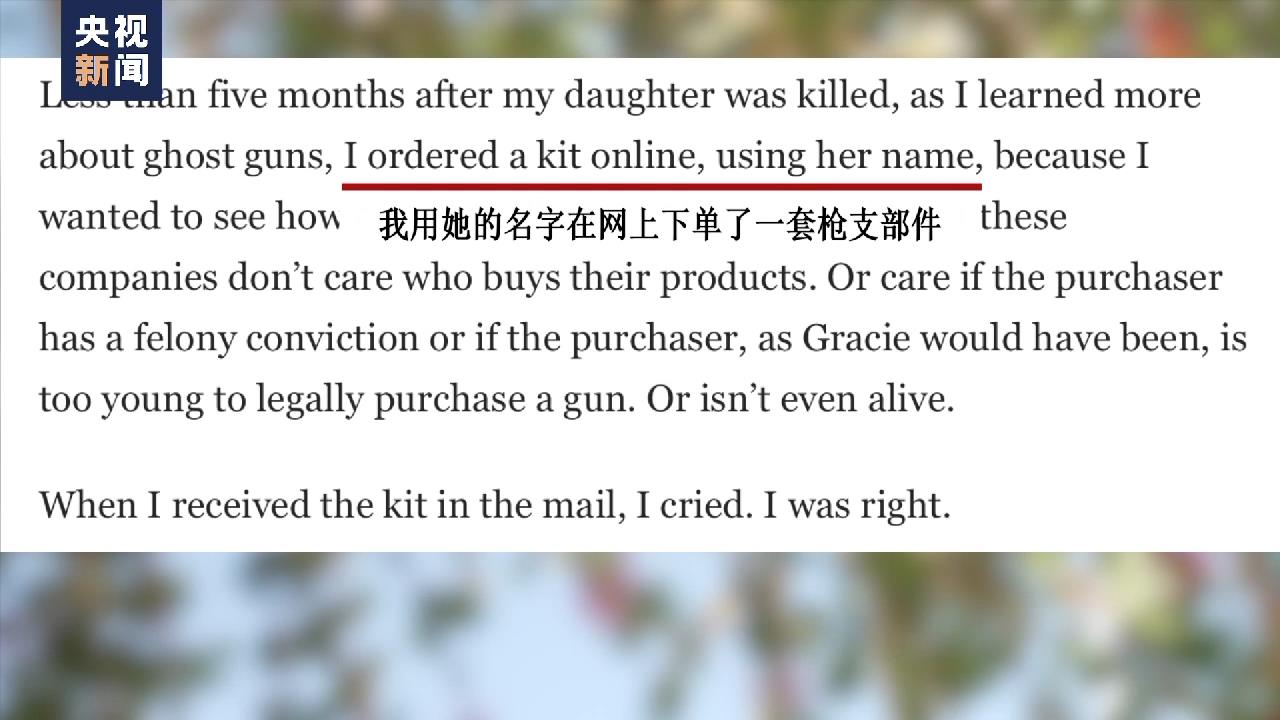

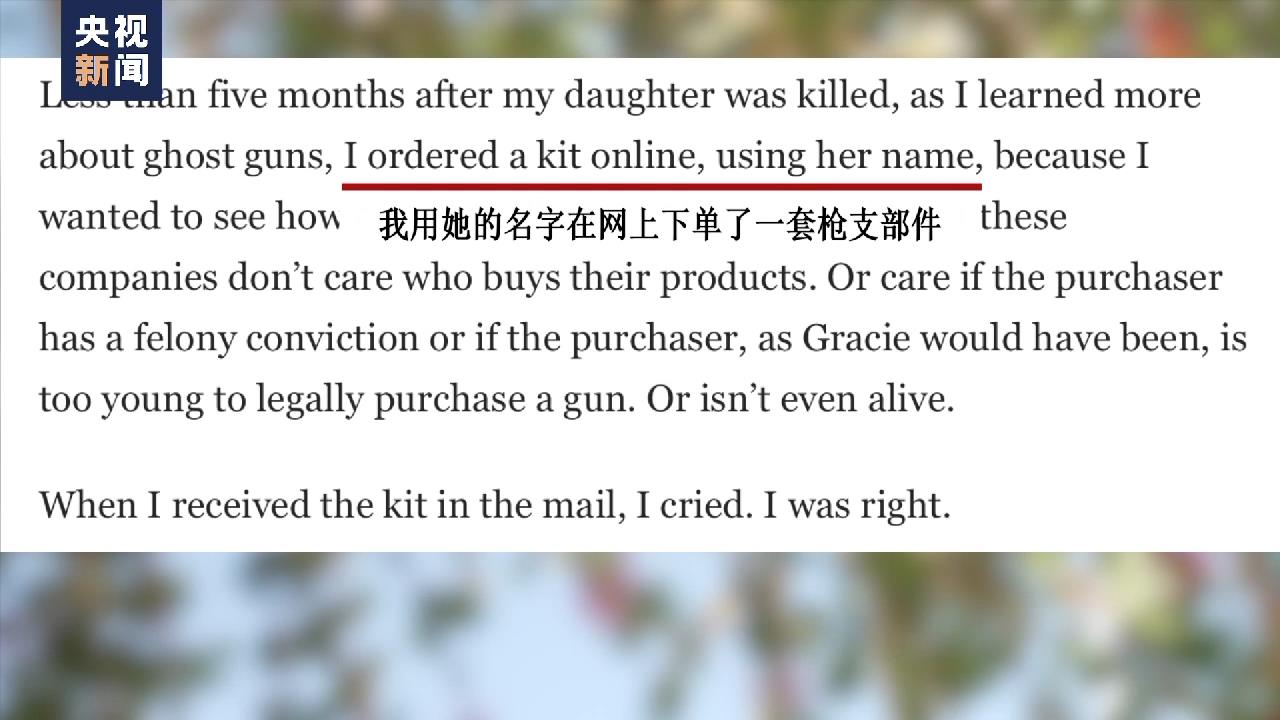

Less than five months after the shooting, the father of Grace Mulberg, one of the victims, successfully ordered a set of gun parts for the "ghost gun" in the name of his dead daughter. He shared this experience in Washington post to expose the darkness of the "ghost gun" industry.

In November, 2017, 44-year-old Kevin Neil killed his wife and neighbors in Lanciotti Black Horse Reserve in Northern California. He then drove into a local primary school and fired more than 100 bullets into the classroom, killing 5 people and injuring 18 others.

Jonathan Loy, the attorney for the victims of the dark horse shooting in Lanciotti and the founder of the anti-gun organization "International Action on Gun Violence":The murderer was not allowed to buy and own guns because he had a criminal record, but he got guns from the seller of "ghost guns" and killed people crazily.

Whether it is a teenager under the age of holding a gun or a felon who is deprived of the qualification to buy a gun, the "ghost gun" has given them a green light without distinction.

Reporter:Why is the "ghost gun" the perfect weapon for criminals?

Jonathan Loy, the attorney for the victims of the dark horse shooting in Lanciotti and the founder of the anti-gun organization "International Action on Gun Violence":It is very simple to get a gun legally in the United States. There are more gun shops than coffee shops and chain fast food restaurants in the United States. The main target market of "ghost guns" is those who cannot legally get guns.

A hole apart, 3D printing gun, haunted by ghosts.

There is a hole in the gun box part, which is a gun. Without a hole, it is just a piece of metal. American gun laws are not only full of loopholes, but also far behind the development of the times and technology. The federal government of the United States tried to "slam the brakes" on the control of "ghost guns", but did it have the expected effect?

3D printing can be traced back to the 1980s, and now people have used this technology to make furniture, food and even medical prostheses.

In 2013, Cody Wilson, the inventor of the American 3D printing gun, completely published a 3D printing data named "Savior" pistol on the Internet for the first time, with 100,000 downloads.

Today, ten years later, supporters of 3D printing guns have spread all over the United States.

Rob pincus, a well-known American gun advocate:We want to show the outside world that many people in the gun group are passionate about 3D printing guns, and this momentum is becoming more and more obvious. In recent years, the group of self-made guns has grown stronger and stronger, and with the support of the industry, we find that the traditional gun industry has gradually accepted this.

Rob pincus used to be a policeman and a gun instructor, but now his focus has shifted to 3D printing guns, and he has frequently endorsed "ghost guns" on TV programs and from the media.

Rob pincus, a well-known American gun advocate:Every gun victim should realize that the injury is not caused by the gun itself, but by the person who uses the gun, and the violence is caused by the person. I don’t think the victims or their families care whether they are 3D printed guns, guns assembled by children or traditional guns obtained through illegal or private channels.

The victims of ghost guns obviously can’t accept this defense.

Mia Tretta, Survivor of the "Ghost Gun" Campus Shooting;("Ghost Gun") is designed to take advantage of loopholes in the law and go beyond the original regulations to ensure our safety. I stand here to tell you that the loopholes in the law are as wide as the Grand Canyon, and the existing gun laws and regulations are far from enough.

In April 2022, the US Department of Justice issued a new regulation, which listed the "ghost gun" kit as a weapon recognized by federal law. However, this regulation is difficult to implement in practice. In March 2023, a federal judge in Texas temporarily suspended the regulations on the grounds that the new regulations were suspected of breaking the law. Several "ghost gun" companies, including "distributed defense", immediately resumed sales.

Rob pincus, a well-known American gun advocate:I don’t think adding 3D printing guns or making laws and regulations in the field of homemade weapons will improve the situation. If it becomes more difficult, more money is needed, more background checks are needed, and more procedures are added, fewer and fewer people will make their own guns, and fewer and fewer gun owners will be more educated and responsible.

Reporter:Many people think that strengthening legal provisions will harm the interests of responsible gunmen.

Jonathan Loy, founder of the anti-gun organization "International Action on Gun Violence":Responsible gunmen also fully support selling guns in the right way to prevent guns from falling into the wrong hands; Responsible gunmen also agree that guns should have serial numbers to provide information for law enforcement agencies. Buyers should do background checks. Many polls show that most people with guns fully support better gun laws.

The "ghost gun" not only gradually broke free from the French Open, but also showed a more fierce side. 3D printing guns without metal parts may escape the security inspection equipment in public places such as airports, creating possibilities for crimes and terrorist attacks.

Jonathan Loy, founder of the anti-gun organization "International Action on Gun Violence":I think the 3D printing gun market may provide convenience for the criminal market, and it will be a potential problem to make guns with 3D printers and provide them to criminal groups.

According to the police records of many States in the United States, mass production of 3D printed guns for criminal groups has become a new trend in the black market of weapons.

Rob pincus, a well-known American gun advocate:The printing data of 3D guns is on the Internet, and 3D printers are readily available. The momentum of people printing guns is unstoppable.

After a whole day’s heat and tympanic membrane stimulation, the contestants voted for the champions of various gun types, but who is the real winner in this "ghost gun" chase?