CCTV News:This time of year is the peak season for college students to find jobs. In order to find a good job, many college students choose the tactics of sea investment and frequently submit their resumes on the Internet. But you know what? What is waiting for them at the other end of the computer is probably not the favor of the employer, but a well-designed trap. Recently, many job-seeking college students told reporters that after an interview, they didn’t find a job, but paid a lot of money to the recruitment company. What happened?

If you want to apply for a job, you must pay for "pre-job incubation"

A few months ago, Xiao Li saw the recruitment information of a technology company on the job search website. The generous treatment made Xiao Li feel a little moved. As a result, after the interview, he not only didn’t get the job he wanted, but also paid nearly 20,000 yuan to the company.

Job seeker Xiao Li: "Just say that because I don’t have any work experience, I need a pre-job training, but this pre-job training needs tuition."

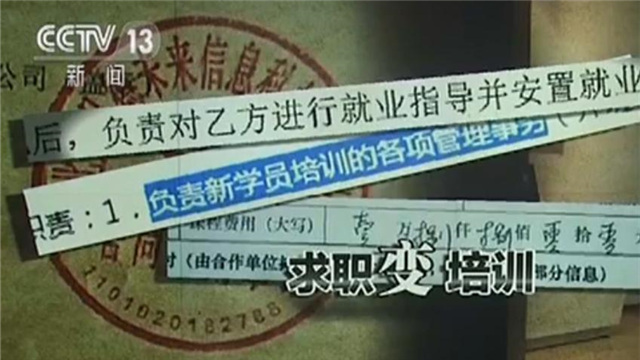

It is normal to give necessary training to new employees who are not familiar with the business, but few of them charge tuition. In order to reflect the formality of the company, the company also took out a contract and asked Xiao Li to sign it.

Employee-to-student employer "second-to-second" training institution

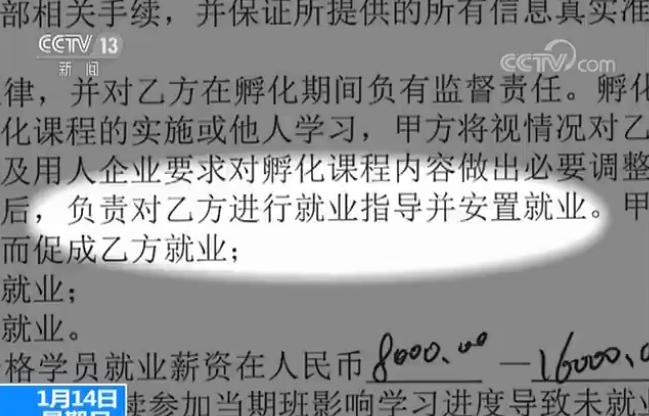

In this agreement, the identity of the job seeker’s signature is not an employee, but a student, and the identity of this company has also changed from an employer to a training institution. In other words, the job seeker signed a training contract with this company, not an employment contract. After paying a high so-called pre-job training fee, the training was completed, but the company didn’t want them. So Xiao Li found this company again. Unexpectedly, at this time, the staff of the company kept silent about the recruitment work, but repeatedly told her that there was no way to get the training fee back.

Staff of Beijing Fande Future Information Technology Co., Ltd.: "Do you have tuition fees for going to New Oriental to learn chefs? After you finished studying, you didn’t enter a five-star hotel or a Michelin hotel. Will he refund your tuition? Will you get a refund for your college tuition? "

Without money, you can train job seekers to bear loans inexplicably.

The technology company started the training business, and the promised "guaranteed employment" was repeatedly denied by the students. Just as the company was questioned, another controversy began to ferment. With the in-depth investigation, it was found that in order to make these college students who have not fully set foot on the society pay the training fee of nearly 20 thousand yuan, the company even made the idea of lending.

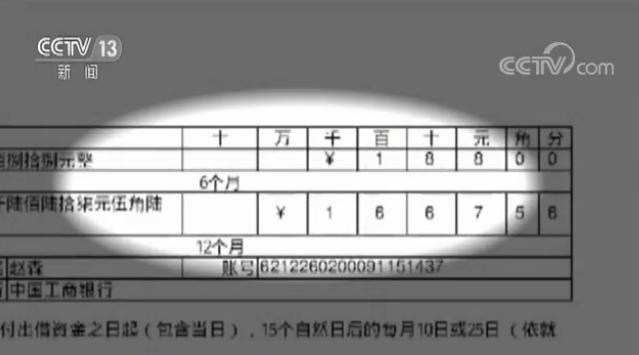

Referring to how to pay the money, these job seekers showed reporters a piece of software called "Yi Xue Loan" in their mobile phones. According to the requirements of this company, they borrowed money from this software and paid the training fee. On the software, the loan chosen by the job seeker is 18,800 yuan, and the recipient is the trained Vander Company. At present, it is necessary to repay the principal and interest of about 22,000 yuan. Without finding a job, it is impossible to "deduct money from wages". These job seekers have to pay for their loans out of their own pockets every month.

This is a software for educational institutions and individuals to help students solve the financial pressure. The feature of this product is: on-the-job, on-campus and unemployed people can apply, and they can apply online only by ID card and bank card.

How to supervise the frequent occurrence of various "routing loans"?

If you fail to apply, you will get an extra interest of three or four thousand yuan out of thin air. Although such deception is not brilliant, these college students with higher education are frequently fooled. In recent years, a large number of routine loans have mushroomed, and beauty loans and plastic surgery loans have emerged one after another. Behind the routine, these microfinance companies that lend money on the Internet are inseparable. Then, in view of more and more loan traps, how should online microfinance companies supervise? How should the lending behavior be regulated?

"Training loan" is actually a new variant of "campus loan"

Dennies Hu, who has been studying online finance for a long time, told reporters that the new "training loan" is actually the latest variant of campus loan in the past. After the regulatory authorities stopped the campus loan of online loan companies in 2016, the education loan platform began to look for a new way out.

When Dennies Hu looked at the loan process of these "training loan" companies, he suddenly raised three questions. For these online lending companies that promote "speed" and "one hour to the account", it is obviously difficult.In December 2017, the regulatory document for online microfinance was officially issued. The document ("Implementation Plan for Special Remediation of Online Microfinance Business Risks of Microfinance Companies") clearly stated: "Strictly examine and approve the qualifications of online microfinance, standardize the business behavior of online microfinance, and severely crack down on and ban institutions that illegally operate online microfinance."

High interest rate of "training loan" and endless financial chaos.

The interest rate of training loans is generally high. In order to make high profits, the loan platform is willing to take risks, and the resulting harm and risks require training students and even the whole society to pay the bill together. These endless "financial chaos" may require the joint supervision of multiple departments.

The "training loan" routine is staged in many places. The Ministry of Education requires strict prevention

First, I was attracted by the recruitment information and went to the interview, then I attended the training because of the "employment commitment", and finally I applied for a loan with mobile phone software. Every step of the so-called "employer" takes advantage of college students’ lack of social experience and eagerness to find a job, but the result is that these college students who can’t find a job bear a loan of 10 thousand yuan and high interest.

For those who really need training, training loan is a valuable financial product, which can alleviate the urgent need of temporary tuition shortage. However, once it is used by training traps, training loan becomes a tool to collect money.At present, this "routine" is no longer a case. Similar incidents have been staged in Beijing, Shanghai, Shenyang, Shenzhen and other places. This trap for job-seeking college students has also attracted the attention of the Ministry of Education.At the recent meeting, the Ministry of Education clearly demanded that illegal activities such as "training loans", job-hunting traps and pyramid schemes should be strictly guarded to effectively safeguard the legitimate rights and interests of graduates.

关于作者